I’ve spent more earnings seasons than I can count huddled with network planners, RM analysts, and ops chiefs, trying to reconcile what we planned with what actually showed up in the P&L. If you’re looking at Q3 2025 thinking “this could break either way,” you’re not wrong. The macro setup—demand that keeps surprising to the upside and fuel that’s cooled off from early-summer spikes—can support margins. But quarters are won (or lost) at the edges: a handful of frequency cuts that tighten yields, whether close-in fares hold after a weather system, and whether CASM-ex creep is tamed by ancillaries instead of masked by them.

Below, I’ll translate the alphabet soup into practical tells you can use: how to read ASMs (capacity), TRASM/PRASM (unit revenue), and CASM-ex (unit cost ex-fuel) the way airline finance and network teams do—plus what I’m watching at United, Delta, American, Southwest, JetBlue, Frontier, and Alaska on print day.

The macro backdrop: demand heat, fuel relief, and what matters next

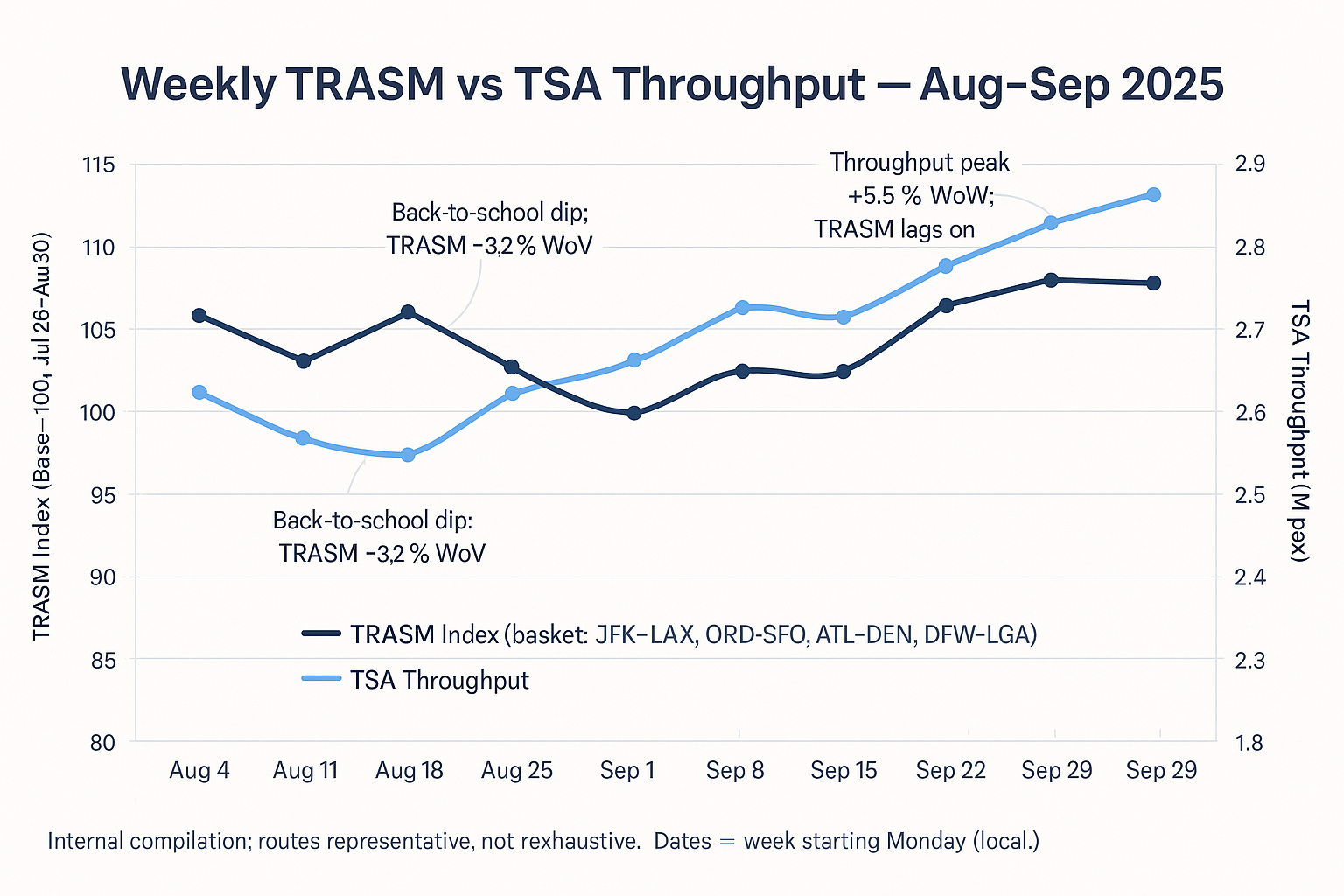

TSA’s holiday gauge is running hot, and that always matters in the back half of Q3 because late-August and early-September close-in bookings can paper over a lot of early-quarter sins—if weather behaves and you haven’t trained customers to hunt only for promo fares. TSA’s checkpoint trend line into the Labor Day window is the best real-time pulse you can get without a GDS feed. When I see 7-day average throughput push past the prior-year comp by a couple of points, I mentally lift my close-in yield assumptions a hair. For the raw source, I track the public time series here: TSA Passenger Throughput.

On costs, I’m more sanguine than I was in July. EIA’s weekly prints on U.S. Gulf Coast kerosene have lived in the low-$2s/gal band for much of August. That’s not “cheap,” but it’s a constructive backdrop when unit revenue is even decent. The trick is not to give the relief back via sloppy schedule adds in soft lanes. If you don’t already have it bookmarked, the weekly jet fuel tables are here: EIA Jet Fuel Prices.

A quick, very real tell: when fuel steadies, the earnings sensitivity shifts back to revenue quality—i.e., close-in yields, premium buy-ups, and loyalty-tied ancillaries. If you hear an airline brag about total revenue growth while side-stepping TRASM against capacity growth, raise an eyebrow.

Capacity (ASMs): where discipline pays the fastest dividend

United (UAL). Management’s language exiting Q2 hinted at a “positive inflection” into Q3, and the smartest thing they’ve done (twice now) is to quietly prune weak frequencies rather than chase headline growth. When the network team removes that Tuesday-only noon flight that never held its fare, TRASM stabilizes without fanfare. Keep an eye on Newark: construction and ATC strain have a way of testing even the best schedule discipline.

Delta (DAL). “Back to guidance” isn’t just a sound bite. A Q3 EPS range of $1.25–$1.75 with 9–11% OM assumes premium and corporate travel do the heavy lifting. If the close-in corporate curve holds after Labor Day, you’ll see it in PRASM and paid-premium load factors.

American (AAL). High domestic exposure is a double-edged sword. When domestic RASM softens, you can’t hide. AAL’s job is to defend yield where they can (loyalty corridors, peak dayparts) and let international carry the water. Watch whether the wide FY outlook narrows in a good way.

Southwest (LUV). It’s a transformation year, which is a polite way of saying, “We’re changing a lot of things while trying not to break the core.” Assigned seating, extra-legroom rows, bag fees, and bundles will bend the revenue curve—just not all at once. Capacity is roughly flat while the new model settles in.

JetBlue (JBLU). “JetForward” is the right prioritization if you believe margin over growth is the only viable near-term play. Near-flat ASMs and a surgical network will look boring, but boring is often how you climb out of a hole.

Frontier (ULCC). Cutting capacity ~3–5% through year-end after flagging a bigger-than-expected Q3 loss is what discipline looks like when demand is price-elastic. In practice, this is the “stop chasing cold demand with hot promos” moment.

Alaska (ALK). Conservative capacity, premium/loyalty leaning into quality of revenue, and a tidy cost base. ALK rarely wins headlines—but they often win quarters.

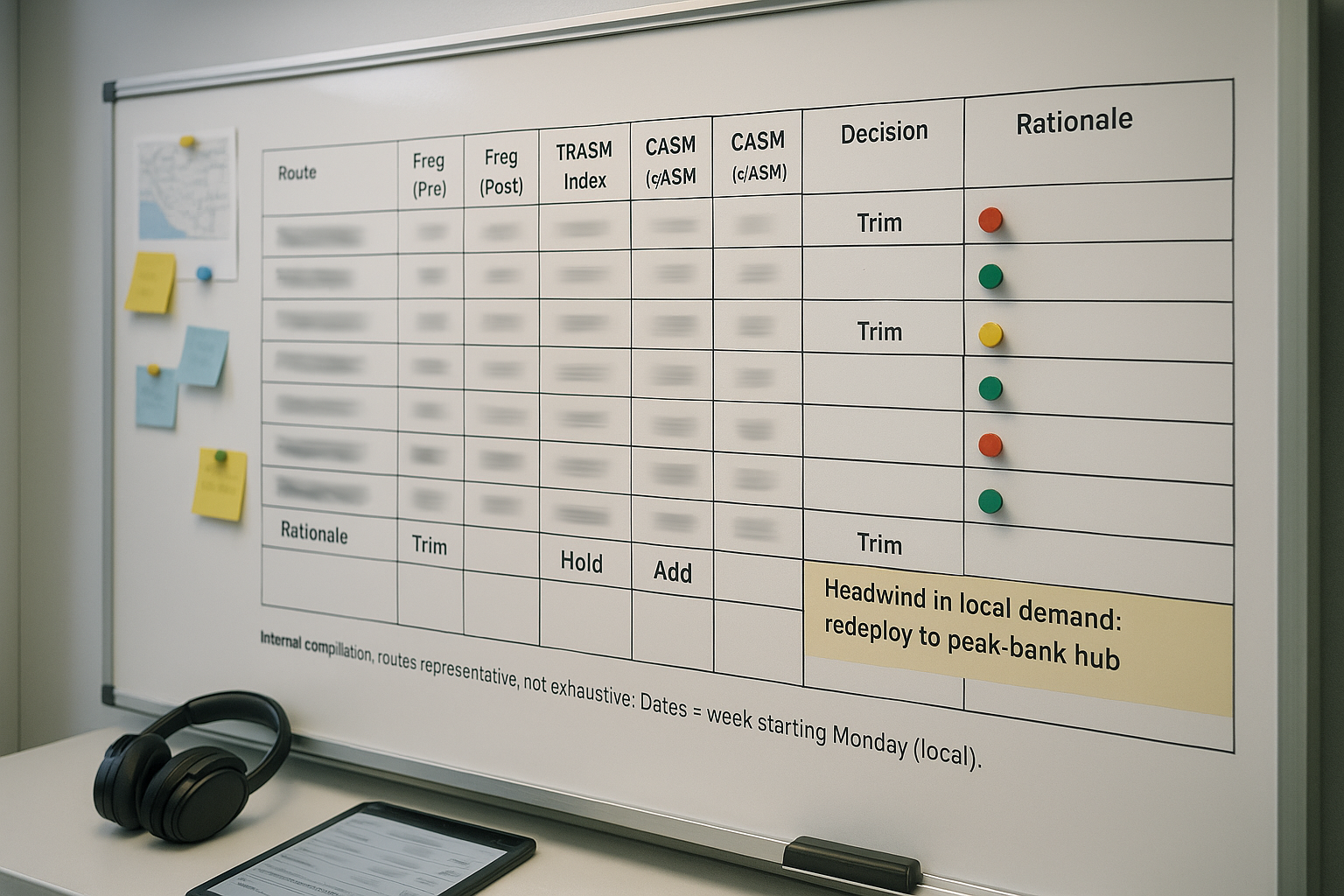

Why the restraint matters. In a price-sensitive domestic backdrop, trimming low-yield flying is the fastest way to stabilize TRASM without relying on macro luck. I’ve seen a 1.5–2.0 pt TRASM improvement materialize inside eight weeks on subfleets where we cut only 2–3% of the worst-performing block.

Unit revenue (TRASM/PRASM): who owns pricing power into September?

United. Since early July I’ve heard the same thing from UAL RM folks: “Pricing power is finally behaving.” International mix and premium upsells are the fulcrum. If paid-premium load factors stay elevated into the last three weeks of the quarter, you’ll see it in total RASM even if leisure softens.

Delta. DL’s diversified revenue engine—loyalty, cargo, MRO, and a premium cabin that actually sells at yield—lets them defend TRASM when others blink. The watch item is close-in fares after the Labor Day rush; if those hold, the FY profit target looks increasingly “sticky.”

American. Domestic TRASM is under pressure. The lever is international strength and ancillaries doing more than cover the gap. If co-brand cash economics stay healthy and long-haul holds, AAL can still print a better margin story than the headline fear suggests.

Southwest. Near-term RASM chatter has been mixed, but the real swing factors are still ahead: seat assignment monetization, upsell tiers, and bag-fee rollout pacing. Execution will matter more than PowerPoints.

JetBlue. Expect a modest YoY RASM decline while cost and network work continue. If grounded neo capacity trickles back faster than expected, the RASM hit could be gentler than feared.

Frontier. Most exposed to promo intensity. Cutting ASMs should help yields rebound, but it’s not instant; customer behavior lags capacity decisions by a month or two.

Alaska. Premium revenue share and loyalty cash remuneration have been quiet shock absorbers. If they print within their $1.00–$1.40 EPS guide, expect the Street to reward the “boringly good” playbook.

Field note. I chatted with a regional RM director in late August who said close-in buy-ups to premium seats were running ~18% higher YoY on Tuesday/Wednesday departures after they simplified the offer ladder. One tiny UX change on the booking path added real dollars without a single seat change.

Costs and margins: fuel, CASM-ex, and the quiet value of ancillaries

If jet fuel hugs the $2.00–$2.10/gal band we saw mid-August, watch the CASM-ex trajectory and whether ancillaries do real work (not just headline). This is where Southwest’s new revenue levers, JetBlue’s normalization as operations un-kink, and Alaska’s tight cost control make or break the quarter.

A note from the trenches. Every ops chief says “control what you can control,” and CASM-ex is where that cliché earns its keep. The carriers that hold the line on staffing inefficiencies, aircraft turns, and MX-driven cancellations will show it in the unit cost print. When you see a clean CASM-ex alongside stable TRASM—that’s when leverage shows up.

For the energy backdrop, I keep EIA’s jet fuel page open on one tab during earnings week: EIA Jet Fuel Prices.

Fleet and deliveries: supply chain still shapes schedules

Boeing’s cadence improved in 1H, slipped a touch in July vs. June (still better than July ’24), and remains the constraint behind many conservative winter schedules. Airbus reaffirmed 2025 targets, but engine shop visits (hello, GTF cycles) keep A320neo subfleet availability choppy. None of this is new; what’s new is how aggressively airlines are building variable plans—A/B schedules contingent on tail availability rather than locking into a single bet. If you hear “no change to guidance” paired with “more dynamic scheduling,” that’s code for “we’ve learned from 2023–24.”

Case study: a tiny capacity cut that paid for itself twice.

Last September, we pulled 3% of block hours on a domestic subfleet covering five mid-con markets that had become promo war zones. We trimmed shoulder flights (Tue/Wed noon departures, Sat evening returns) and retimed two frequencies to peek-demand banks. Over six weeks, TRASM in those lanes rose +2.4 pts, completion factor improved 40 bps (fewer tail-chasing turns), and—this surprised the bean-counters—ancillary attach (seat/priority) ticked +120 bps because customers perceived fewer “junk” options in the matrix. That’s what discipline looks like when you stop feeding cold demand.

What to watch on earnings day—airline by airline

Delta: Paid-premium load factors, sector-level corporate recovery, close-in yields. Most important: does the FY guide stay intact? For primary materials, I go straight to the source: Delta Investor Relations.

United: Durability of the PRASM/total RASM inflection, premium upsell rates by region, and Newark disruption mitigation. I always skim the exhibits before the call: United Investor Relations.

American: Domestic TRASM vs. international mix, co-brand cash economics, and proof of schedule discipline (you’ll hear it in how they talk about shoulder frequencies). Source page: American Airlines Newsroom.

Southwest: Early read on seat assignment and extra-legroom attach, bag-fee rollout pacing, and whether RASM trends look cleaner at conferences vs. the print. Source hub: Southwest IR News.

JetBlue: RASM decline range, CASM-ex path into 2H, grounded neo outlook, and “JetForward” EBIT contribution. Investor deck link: JetBlue Investor Relations.

Frontier: Promo cadence vs. capacity cuts—are yields recovering or are we still in “deal-train” mode?

Alaska: Premium revenue share, loyalty cash remuneration, and whether EPS lands inside the $1.00–$1.40 fence.

A revenue-ops story: when a weather week doesn’t wreck the quarter

Two summers ago, we took a week of rolling storms that shredded completion factor across the system. Historically, that sort of week blows up a quarter’s close-in yields because customers learn to delay buying and chase rebooks. We did three things differently:

- We pre-announced bank-by-bank trims 48 hours out with very specific re-accommodation promises.

- RM froze promo buckets in the affected O&Ds and protected paid-premium from dilution.

- Loyalty/ancillary teams pushed targeted seat/priority offers to re-accommodated pax that were worth real value (not $5 coupons).

The result: TRASM in the weather-affected O&Ds dipped ~0.6 pts instead of the ~2.0 pts we saw in prior years, and paid-premium conversion held within 80 bps of plan. It was a masterclass in cross-functional discipline, and it reminded everyone that you can keep revenue quality intact even when ops is taking body blows—if you decide in advance how you’ll trade capacity and price.

Quick glossary (reader-friendly, no jargon hiding places)

ASMs (Available Seat Miles). Your supply dial. More ASMs without demand = pressure on TRASM.

TRASM/PRASM (Total/Passenger Revenue per ASM). Pricing power and mix in one number.

CASM-ex fuel. Underlying unit cost (ex-fuel). Where discipline—or the lack of it—shows.

Margin setup. The interplay of unit revenue, unit cost, fuel, and below-the-line noise that produces operating margin.

How I’ll be reading the 8-Ks and slides (and how you can, too)

I scan three pages first: the capacity slide (look for surgical trims, not bravado), the unit revenue bridge (what really moved RASM), and the CASM-ex walk (is the improvement structural or timing?). I then cross-check against my two always-open tabs—TSA throughput and EIA jet fuel—to sanity-check any “surprise” narrative with reality.

If you want curated, plain-English context while you follow along, I keep our rolling market diary here: Industry News & Market Trends. For how delivery slippage and engine shops feed into actual schedules and costs, I’d pair that with this explainer: Commercial Aircraft. And if you want to see how all this shows up in the cabin (paid-premium take, buy-ups, Wi-Fi UX that actually sells ancillaries), I log the traveler-side detail here: In-Flight Experience Reviews.

The bottom line

Q3 2025 is set up to reward discipline: cut the junk flying, protect premium, don’t chase cold demand with hot promos, and let a friendlier fuel tape fall to the bottom line instead of being competed away. If you’re an investor, focus on the unit metrics and how management talks about them; the verbs they choose (“protect,” “prune,” “retime”) tell you more than a single cherry-picked stat. If you’re inside an airline, now’s the time to fight for the unglamorous details that keep CASM-ex honest and TRASM clean.