The 2025 reality: price spreads are huge—use them

Charter pricing is more fragmented than ever. Hourly ranges overlap across categories (think $2k–$6k+ per hour depending on size/age/availability), and day-to-day demand swings can add thousands. Your edge: shop direct, stay flexible, and control fees—not just the headline rate. Paramount Business Jets+2Clay Lacy Aviation+2

Quick wins (you can use on your next quote)

- Book wholesale/direct-to-operator quotes.

Use a direct marketplace/app that lets you request quotes from operators (not just brokers). More net-cost quotes = better leverage and fewer middle-layer markups. Tools like JetASAP (now under FlyHouse) were built exactly for this and are widely reported for enabling direct-to-operator pricing. Also know that many brokers source supply from Avinode, the pro marketplace—so it pays to understand where quotes originate. Avinode+3Private Jet Card Comparisons+3Forbes+3 - Target “empty legs” and “transient” aircraft—eyes wide open.

Empty legs can cut costs 50–75% if you’re flexible, because you’re filling a reposition flight the operator would fly anyway. But they’re not guaranteed—if the primary trip moves, your deal can evaporate with short notice. Treat empties as opportunistic, not mission-critical. Forbes+3jettly.com+3GlobeAir+3 - Pick the right airplane, not the fanciest one.

For sub-500 nm trips, a turboprop (Pilatus PC-12, King Air 350) often beats a light jet on total cost with minimal time penalty—typical ~$1.7k–$2.5k/hr versus jets that often price higher. For 900–2,200 nm, midsize/super-mids hit the sweet spot on speed/range vs. ferry fees. Don’t over-airplane your mission. Air Charter Advisors+2Paramount Business Jets+2 - Use secondary airports to kill fees and ferries.

Big hubs can mean bigger FBO/handling charges and longer taxis. Nearby GA fields (e.g., TEB instead of JFK; VNY instead of LAX) can trim time on the meter and avoid congestion. Ask each operator which airport keeps their reposition the shortest. - Fly off-peak + step off the exact time.

Move your departure ±12–24 hours or slide midday instead of 8am/5pm to skip peak-day surcharges and to match transient aircraft passing through. Operators discount when your schedule fits their fleet flow. - Insist on an “all-in” apples-to-apples quote.

Besides the hourly, you’ll likely pay U.S. 7.5% Federal Excise Tax (plus per-segment fees), overnights, international handling, de-icing (in winter), wi-fi, catering, and reposition. Get each line item in writing; you can negotiate caps on de-icing/overnights. NBAA+1

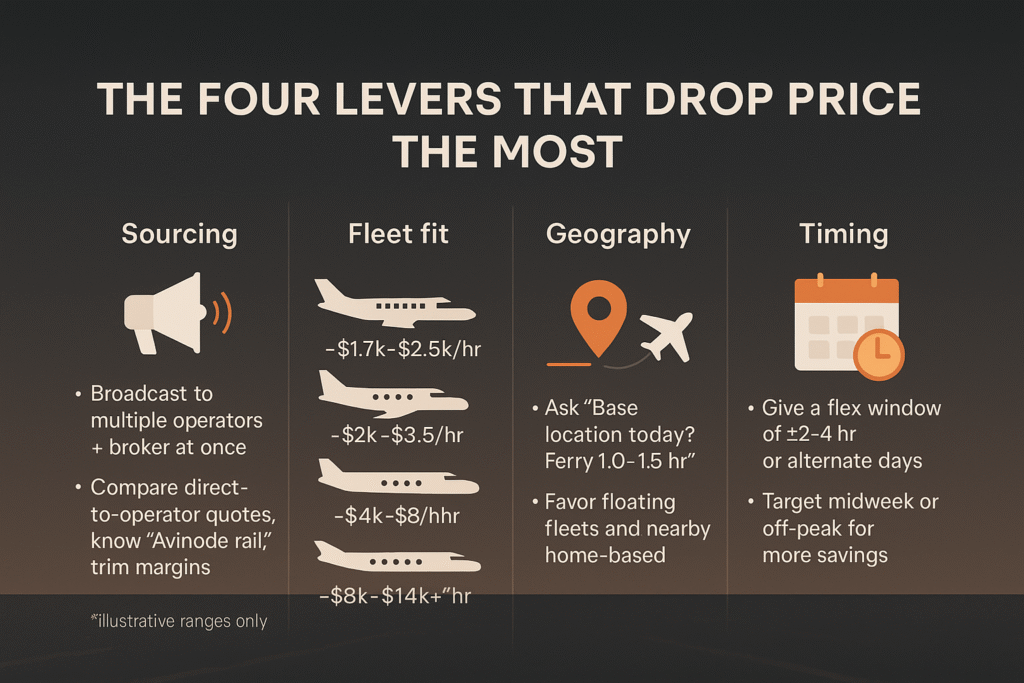

The four levers that drop price the most

1) Sourcing: how you ask for lift

- Broadcast your trip to multiple operators (and a broker you trust) at once. Direct-to-operator models let you compare net operator quotes, not just retail packages. Private Jet Card Comparisons+1

- Know that many broker quotes are built on the Avinode supply rail. If you already have multiple operator bids in hand, brokers will often trim margin to win. Avinode+1

2) Fleet fit: aircraft class vs. mission

- Turboprops (PC-12 / King Air 350): ~$1.7k–$2.5k/hr; perfect for 1–2 hour hops, short strips, ski/beach towns. Air Charter Advisors+1

- Light jets: often from ~$2k–$3.5k/hr; good for 2–3 hour legs, 4–6 pax. Jet Finder

- Midsize / Super-mid: ~$4k–$8k/hr; sweet spot for U.S. coast-to-coast efficiency. Paramount Business Jets

- Large/ULR: often $8k–$14k+; only pay it when range or cabin truly require it. Paramount Business Jets

3) Geography: airports & reposition

- Ask each bidder: “Where is this airplane based today? What’s the ferry?”

A $700/hr cheaper jet can be more expensive once you add a 1.0–1.5 hr reposition. Favor floating fleets and nearby home-based aircraft.

4) Timing: off-peak, flexible windows

- Give a +/- 2–4 hr window or alternate days. That lets operators slide your trip into a gap, often shaving hundreds to thousands off the quote.

Empty legs: the smart way (and the fine print)

- What they are: discounted one-way reposition flights.

- How to book: subscribe to alert lists and be ready to wire quickly (Magellan, Jettly, GlobeAir in Europe, and many brokers publish live boards). Magellan Jets+2jettly.com+2

- Big caveat: empties can be canceled or retimed last-minute if the primary trip changes; have a backup plan (airline ticket, alternative charter). PrivateFly+1

Cut the “gotcha” fees (the silent budget killer)

- Taxes: U.S. charters typically add 7.5% FET plus per-segment fees—make sure every quote states taxes separately so you can compare net vs. gross. NBAA

- De-icing: Can run thousands per event in winter; try for a de-icing cap or hangar pre-heat inclusion. (Some programs even include it because single events can hit five figures.) Private Jet Card Comparisons

- Overnights & crew duty: Ask for duty-day planning to avoid overnight charges on out-and-backs.

- Wi-Fi/data: Heavy streaming can be billed per MB—ask for the rate or a cap.

- Catering & FBO fees: Pick simpler FBOs and bring light catering when allowed.

Safety (non-negotiable) without paying a premium

Low price ≠ low standards. Ask for:

- Part 135 certificate (name/number) and insurance limits.

- Third-party audit status (e.g., ARGUS, WYVERN) and IS-BAO registration, a globally recognized code of best practices aligned with ICAO SARPs. These don’t guarantee perfection, but they’re strong indicators of safety culture. solairus.aero+2Latitude 33 Aviation+2

Sample outreach that gets operators to sharpen the pencil

Subject: One-way charter — DAL → VNY, 4 pax, flexible window

Body (copy/paste):

“Looking for DAL→VNY on Tue 22 Oct (±4 hours), 4 pax, 4 small bags. Willing to use VNY/BUR/ONT if it reduces ferry/fees. Prefer PC-12/KA350 or light jet depending on availability. Please quote all-in with: hourly + ferry, 7.5% FET/segment fees, FBO/handling, de-icing policy (if applicable), wi-fi rate, and overnight if required. Confirm Part 135 certificate, ARGUS/WYVERN/IS-BAO status, A/C tail/current position, and cancel terms. Happy to depart Wed 23 if it captures a transient aircraft or empty leg.”

Why it works: it signals flexibility (dates/airports/aircraft), requests all-in transparency, and name-checks safety—all triggers for sharper, credible quotes.

Two real-world pricing frames to think in

- Short hop (300–400 nm):

PC-12/King Air at ~$2k–$2.5k/hr often beats a light jet after taxi and ferry are counted, with only ~10–20 minutes difference block-to-block. Air Charter Advisors+1 - Medium haul (1,500–2,000 nm):

A super-mid may look pricier per hour, but one tech stop you avoid can save time + fees and deliver a lower all-in than a smaller jet doing two legs. Paramount Business Jets

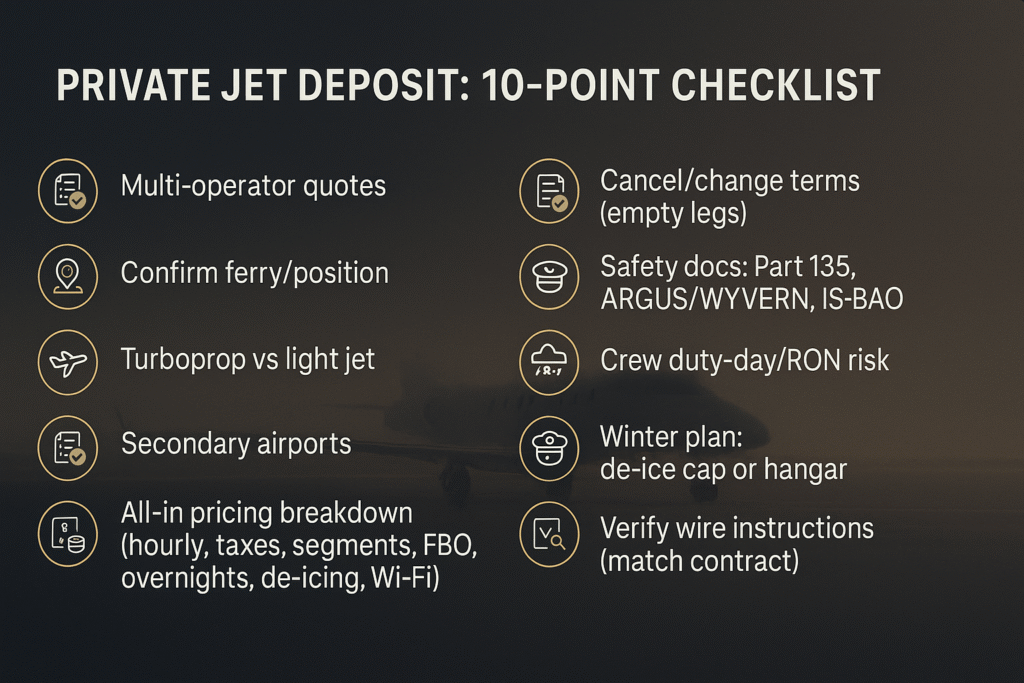

10-point checklist before you pay the deposit

- Got 3–5 operator quotes (not just broker bundles)? Private Jet Card Comparisons

- Confirmed ferry time and current aircraft position?

- Compared turboprop vs light jet for short legs? Air Charter Advisors

- Asked for secondary airports to cut fees?

- Quote shows hourly + taxes + segment + FBO + overnights + de-icing + wi-fi? NBAA

- Cancel/change terms spelled out (esp. on empty legs)? PrivateFly

- Safety docs: Part 135, ARGUS/WYVERN, IS-BAO? NBAA

- Crew duty-day checked to avoid surprise RON?

- De-icing cap or hangar plan if winter ops? Private Jet Card Comparisons

- Final wire instructions match the operator/broker you contracted?

What “good” pricing looks like in 2025 (rule of thumb)

- Turboprop (PC-12/KA350): ~$1.7k–$2.5k/hr all-in before taxes, depending on market and ferry. Air Charter Advisors+1

- Light jet: often $2k–$3.5k/hr in competitive lanes. Jet Finder

- Midsize / Super-mid: $4k–$8k/hr depending on day/region. Paramount Business Jets

- Large/ULR: $8k–$14k+ when you truly need it. Paramount Business Jets

Remember: a short ferry and no overnights can beat a slightly lower hourly every time.

You don’t need a jet card to pay less in 2025. Source widely (and directly), stay flexible on airports/times/aircraft, exploit empty legs when schedules allow, and lock down fees with all-in quotes. Do that—and keep Part 135 + third-party safety non-negotiable—and you’ll consistently land the lowest private jet price the market will yield on any given day. Private Jet Card Comparisons+2Magellan Jets+2