I’ve been in enough late-night diligence calls with PtL developers to know the moment everyone leans in: when the model flips from red to black on the strength of §45Z. In 2025, that swing can be enormous—if you keep lifecycle carbon intensity (CI) close to zero and you don’t trip prevailing-wage and apprenticeship rules. Here’s the plain-English version of the math we actually use on deals, the paperwork that survives auditor scrutiny, and a near-miss that taught my team why power bookkeeping matters just as much as electrolyzer efficiency.

The quick answer—translated from tax-speak

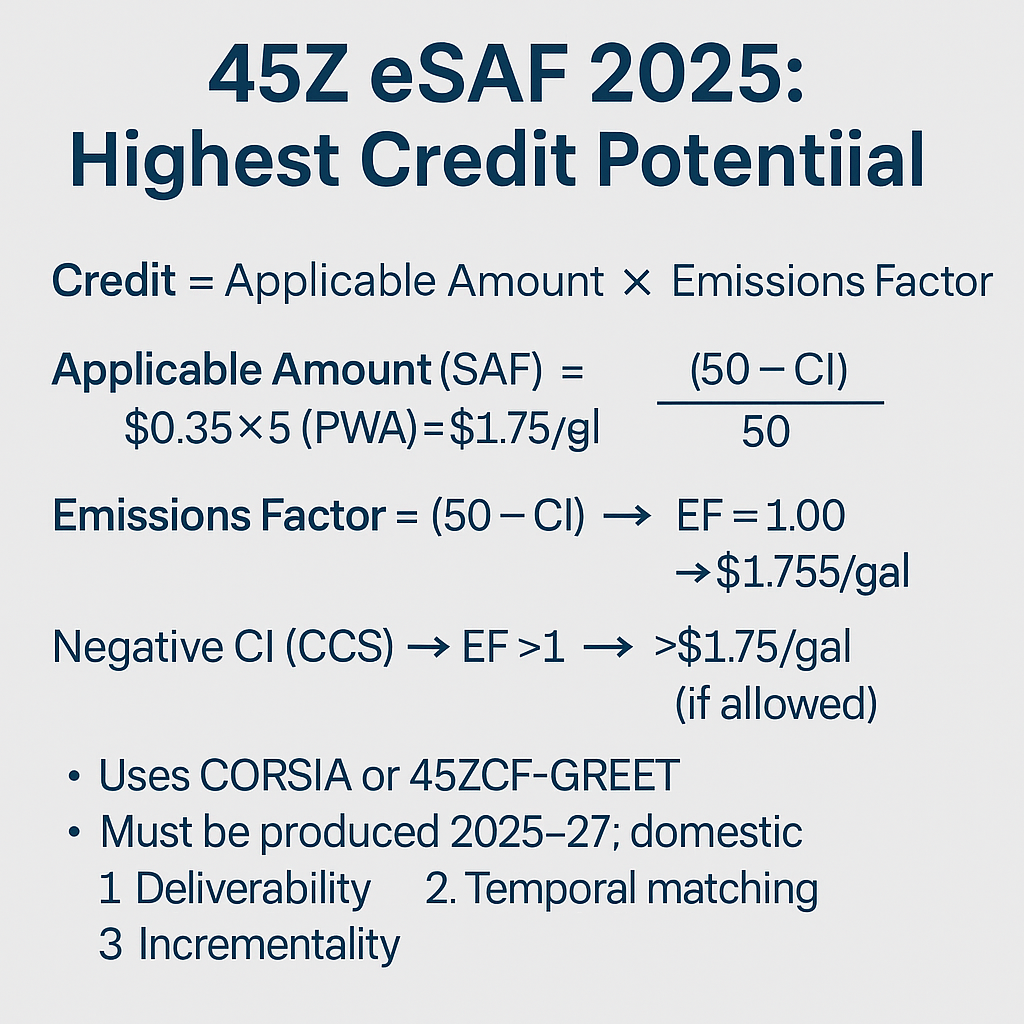

For 2025, SAF produced and sold in the U.S. can earn an applicable amount of $1.75/gal when prevailing wage & apprenticeship (PWA) requirements are satisfied; without PWA it’s $0.35/gal. You then scale that by your fuel’s emissions factor, which §45Z defines as (50 − CI) / 50, with CI in kgCO₂e/MMBtu. If your eSAF lands near CI ≈ 0, your factor is ≈1.0—and you’re effectively at the top of the 2025 range (inflation adjustment gets added when the IRS publishes it for the sale year). The IRS summary page is the safest place to anchor your model; it lays out the credit structure and timing cleanly in one spot via the Clean Fuel Production Credit overview. (See: the IRS explainer.) IRS

What I’ve learned is that teams get burned when they assume “we’re green, therefore the max credit.” §45Z pays for measured lifecycle performance, not slogans. Your modeling and your receipts have to agree.

What changed in 2025—and why PtL should care more than anyone

Two lifecycle accounting routes are now expressly allowed for SAF under §45Z: CORSIA (Default or Actual) and DOE’s 45ZCF-GREET. If you haven’t read it yet, block 30 minutes to open Notice 2025-11—it’s the document you’ll end up quoting in your term sheets and auditor memos because it spells out the allowable LCA methods and even how to petition for a Provisional Emissions Rate when you don’t see your exact pathway in the table. I keep a copy bookmarked here: IRS Notice 2025-11 (PDF). IRS

On the DOE side, 45ZCF-GREET and its user manual (May 2025) are where the rubber meets the road for PtL. The manual confirms how to treat electricity accounting—that you can apply qualifying EACs/RECs for wind/solar/hydro to model zero-emissions power when you meet the evidence and matching rules. For a PtL plant—where electrons drive both electrolysis and synthesis—those few pages decide whether your CI pencils near zero or slumps toward grid-average. Keep the manual handy: 45ZCF-GREET User Manual (May 2025, PDF). The Department of Energy’s Energy.gov

If you want a running “what changed this week” translation for your ops and finance teams, we post quick reads and links as rules evolve in our Regulatory Updates hub; it’s where I drop notes after parsing IRS/DOE releases so you don’t have to reinvent the wheel: Regulatory Updates.

The 2025 math you’ll actually show your CFO

Scenario. A U.S. PtL facility produces 5 million gallons of eSAF in 2025 and meets PWA. Verified lifecycle CI (via CORSIA Actual) is 3 kgCO₂e/MMBtu.

Emissions factor = (50 − 3) / 50 = 0.94.

§45Z credit = $1.75 × 0.94 = $1.645/gal.

Annual credit = $8.23M (pre-inflation).

Nothing exotic here—the art is achieving and evidencing that CI. The IRS and AFDC both point to the same headline numbers for 2025 (with and without PWA), which is why I cite them in every board deck. (AFDC’s program page is concise and plain-English.) IRS+1

From experience, teams that write the documentation plan (metering, EAC procurement/retirement, CO₂ chain-of-custody, unrelated-party sales) at the same time as the P&ID hit their number months faster than teams that bolt paperwork on at the end.

A real-world near-miss: the $0.24/gal hole that REC timing dug

Last spring, we audited a PtL project that swore it was a “CI ≈ 1” machine. The kit looked terrific: high-efficiency electrolysis, clever synthesis heat integration, tight utilities. Then we opened the power file. Their renewable EACs didn’t time-match the production run, and REC retirement happened after the reporting window. On a strict read of the 45ZCF-GREET manual, those hours had to revert to grid average. CI jumped toward ~9, which would have shaved roughly $0.24–$0.28/gal off the §45Z payout at 2025 rates. We fixed it—re-procured hourly-matched EACs, shifted the test plan into the matching window, retired RECs immediately, and re-ran the model. CI dropped back to ~2–3 and the financing closed. The lesson: your electrons are as real as your equipment, and the model treats them that way. The Department of Energy’s Energy.gov

When we turn those lessons into repeatable workflows for new hires and auditors, we actually rehearse the “paper flight” in a sim playbook—file handling, evidence checks, sign-offs—so mistakes surface before first fuel. If that sounds useful, we host those dry-run guides in Simulator Technology: Simulator Technology.

2026–2029: why you can’t drag-and-drop the 2025 economics

On July 4, 2025, the One Big Beautiful Bill Act became law, extending §45Z through 2029. Multiple legal summaries flagged a key nuance for SAF: the applicable amount for SAF drops after 2025 (common shorthand you’ll hear is “$1.75 → $1.00/gal” for post-2025 production). Don’t just roll your 2025 per-gallon benefit forward—rerun out-years with the lower applicable amount and the IRS inflation factor for each sale year. (See a representative legal brief for the extension and rate change.) Sidley Austin

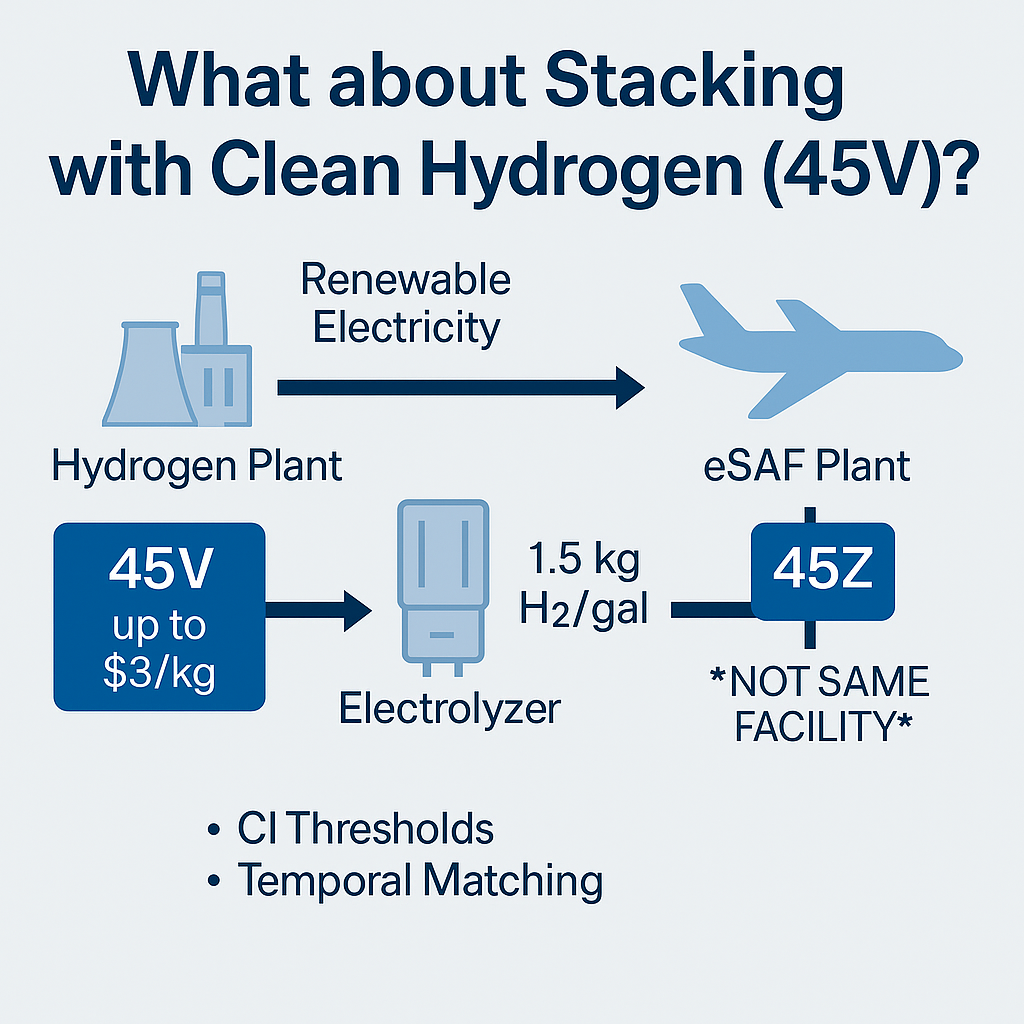

Practically, the 2026–2029 projects that still clear their IRR share the same habits: bulletproof PWA from day one; hourly-matched clean power with receipts; and a clean structural separation if you’re also using §45V upstream (hydrogen) so you don’t run afoul of §45Z anti-stacking at the fuel plant. We keep the offtake/policy cross-reads updated in News & Market Trends so you can align contract timing with credit mechanics: News & Market Trends.

How to actually hit the top of §45Z in 2025 (what’s worked for my teams)

Go all-in on zero-carbon electricity with EACs/RECs that match your hourly production footprint; document procurement, retirement, and meter intervals like an auditor will. Use DAC or another permitted CO₂ stream and make sure your chosen lifecycle method treats that source the way you think it does (CORSIA vs 45ZCF-GREET details differ). Lock PWA into your EPC and subcontractor language so you’re not chasing affidavits at COD. For a quick sanity check on values (and to brief non-technical execs), I still point folks to AFDC’s clean-fuel credit explainer because it mirrors the IRS numbers without the statutory jargon. Alternative Fuels Data Center

Bottom line

For 2025, eSAF can legitimately reach the top of §45Z—effectively $1.75/gal × emissions factor ≈ 1.0—if you keep CI near zero and you meet PWA. Starting in 2026, the credit still matters, but your economics depend even more on disciplined electricity matching, clean hydrogen strategy, and documentation that would make a tax auditor smile. If you need the source texts your finance and legal teams will ask for, anchor on the IRS’s Clean Fuel Production Credit page and Notice 2025-11; for modeling specifics, keep the 45ZCF-GREET User Manual at your elbow. IRS+2IRS+2